What To Do When The At-fault Chauffeur Does Not Have Adequate Insurance https://connergiyj841.image-perth.org/do-i-require-a-lawyer-for-a-car-crash-recognize-when-it-matters-most Protection

Because insurance companies aim to reduce payments, policyholders might encounter challenges in securing complete settlement, making thorough documentation crucial. In South Carolina, the minimum limitation for liability insurance policy coverage is $25,000. UM is made to cover you and your family members for injuries endured in a crash while riding in one more cars and truck or perhaps when out strolling or cycling.

Minimal Obligation Insurance Coverage Requirements In North Carolina

From taking care of the trivial matters of insurance policy claims to exploring every possible opportunity for payment, a lawyer can make all the difference in the after-effects of a mishap with an uninsured vehicle driver. Health insurance policies normally have limits on certain types of therapies or rehab services. These might not fully meet the requirements of those recovering from automobile mishap injuries.

For that, you would need to get without insurance driver property damages insurance policy, though this may not cover damaged building aside from your car. This kind of insurance coverage may additionally not cover hit-and-run accidents and is not readily available in all states. Without insurance motorist insurance is an additional sort of insurance coverage in addition to a conventional car obligation insurance policy. The expense varies extensively, however a ballpark figure is approximately 5 percent of your annual car insurance policy premium. So if you presently pay $ 800 a year for car insurance coverage, uninsured/underinsured driver insurance coverage might add $ 40 to your yearly fees.

Various other states may call for extra protections like accident protection (PIP), which pays for your medical expenditures regardless of that's at mistake in a mishap. You can choose without insurance driver coverage "added to" at-fault obligation restrictions. Or, you can decline this in composing and instead choose uninsured driver insurance coverage "reduced by" at-fault liability limitations. It's just as it sounds, with the "added on to" protection including the UIM to the obligation https://postheaven.net/albiussfjx/what-can-i-demand-in-a-truck-crash-claim-puzzle-and-riddle-injury-attorneys restrictions and the "decreased by" minimizes your UIM payment by the at-fault party's obligation restrictions. Unless your state needs UMPD protection, you most likely do not require it if you already have collision insurance policy. That's since crash insurance coverage pays for damage to your cars and truck despite who created the crash.

Compare Auto Insurance Policy Rates 2025

What's The Due Date For Submitting An Uninsured Driver Insurance Claim?

- Lenders normally call for vehicle drivers to preserve both kinds of insurance coverage until the loan is settled or lease is up.Allow's say, for instance, the at-fault chauffeur has a $100,000 plan limit acquired with their insurance company, but your damages total $170,000.Uninsured vehicle driver protection costs approximately $136 a year, according to Forbes Consultant's evaluation.For example, if you include a teen vehicle driver to your policy, be gotten ready for a significant bump in vehicle insurance policy premiums.What's more, the different insurer that provide extra UM/UIM coverage for the case are not mosting likely to offer that insurance coverage exists.

You could lose your license, have your automobile eliminated, face penalties, and also most likely to prison. Additionally, your insurance policy rates will certainly rise when you finally get coverage. If you're struck by someone without insurance coverage, you may require assistance from a legal representative.

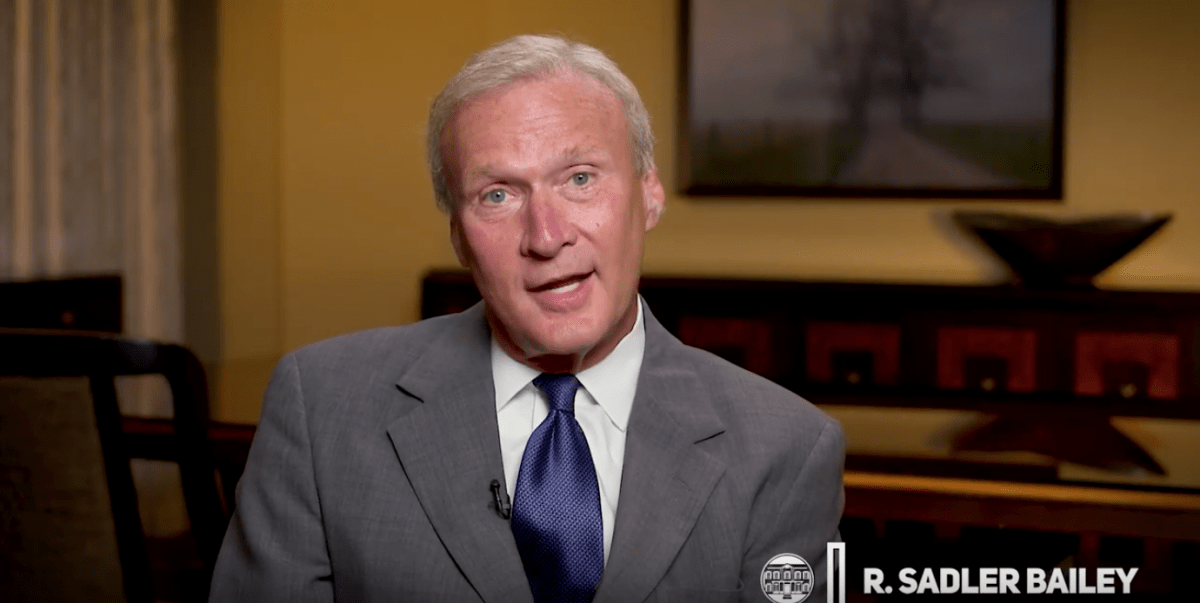

A lawyer who lacks the understanding of car insurance policy might not recognize the availability of UM/UIM protection. If you have this coverage, it can considerably reduce the monetary problem of a mishap with an underinsured driver. While these minimal limitations vary by state, they are usually not enough to cover the complete extent of problems in a severe mishap, leaving accident sufferers undercompensated. Cristen Bartus techniques personal injury regulation in North Carolina at the Legislation Offices of James Scott Farrin. Courts can provide judgments needing payment, and if the without insurance chauffeur lacks funds, their assets-- such as savings accounts, vehicles, or even future wages-- might undergo garnishment or seizure. Some states enable installment layaway plan for court-ordered problems, but the monetary pressure continues to be. An underinsured vehicle driver insurance claim will normally take a little longer to develop, a minimum of till your medical therapy proceeds and you get an understanding of the value of your vehicle crash situation. Once you think that your case is worth more than the accused's liability coverage, notify your insurer immediately that you mean to make an underinsured driver case. If you are associated with a car accident and the at-fault motorist doesn't have insurance policy, you still have choices for recovering settlement. Recognizing North Carolina's insurance coverage demands is essential if you are ever before in a cars and truck accident, especially when the at-fault chauffeur doesn't have insurance policy.